Bank Nifty 10th Nov

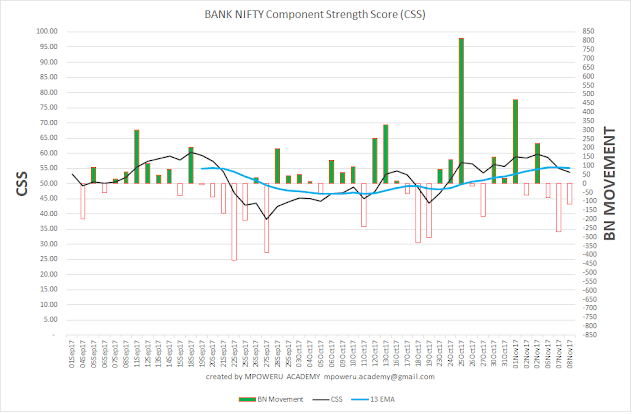

Commentary On Index: Date : 10th Nov Day Stats : A bullish day with a gain of 207 points. Day: Up Day Candle pattern: Bullish Candle after a neutral candle confirm trend reversal. Healthy long body with very small lower wick and small upper wick i.e. opened near the low and closed near the high. Range: Wide ... indicating demand exceeded supply Volume: Improved from last two/three days and closer to average (though slightly below average) BANK NIFTY COMPONENT STRENGTH SCORE 10 NOV 17* Component Strength Score : 54.75 EMA : 55.13 Interpretation : Neutral/Sideways. Candle indicating gathering of bullish momentum. *ABOUT COMPONENT STRENGTH SCORE I am experimenting and developing a Component Strength Score based on the study of the underlying constituents of the Index itself. I have started with Bank Nifty. Here is a WIP version. The graph has three data points The movement of BN itself (absolute points), then ...